What Multiple do Businesses Sell For?

- Jul 13, 2022

- 3 min read

Industry insiders, buyers and sellers sometimes talk about multiples of revenue as a metric of company value. To calculate what multiple businesses sell could sell for you can take any price and divide it by the annual revenue of a business and obtain a revenue multiple or fraction thereof. A $1 million sale price divided by $2.5 million in annual revenue equals a 0.40x revenue multiple. In some high growth technology companies people talk about a multiple such as 2x or 3x Revenue = Company value.

Are multiples the best way of valuing a business?

But revenue is a very poor indicator of value. It’s like talking about the price per square foot of a home. Price per square foot is a way to conceptualize value or price but by itself, it is not a very useful metric without direct comparison, and a given square footage price by itself does not drive value. The price per square foot value of a home is driven by a myriad of other factors, such as the age, construction, and quality of materials, lot size, condition, neighborhood, and geographic location. In terms of real estate, the location of a home is the primary driver of value. And so the value per square foot could swing from as much as $10 to $1,000 or more.

Limitations of Valuation Based on Revenue

Buyers, sellers, lawyers, accountants, and the tax man will want to know the level of revenue but also the growth rate, annual profit, profit margins, customer concentration, management depth, industry trends and prospects, and the risk factors associated with the above. But it all gets down to what each real or hypothetical buyer thinks the business will or can earn on the bottom line profit (more specifically cash flow). What people are willing and able to pay for a business is a function of the profit or cash flow they expect the business to generate.

What is a reasonable valuation multiple?

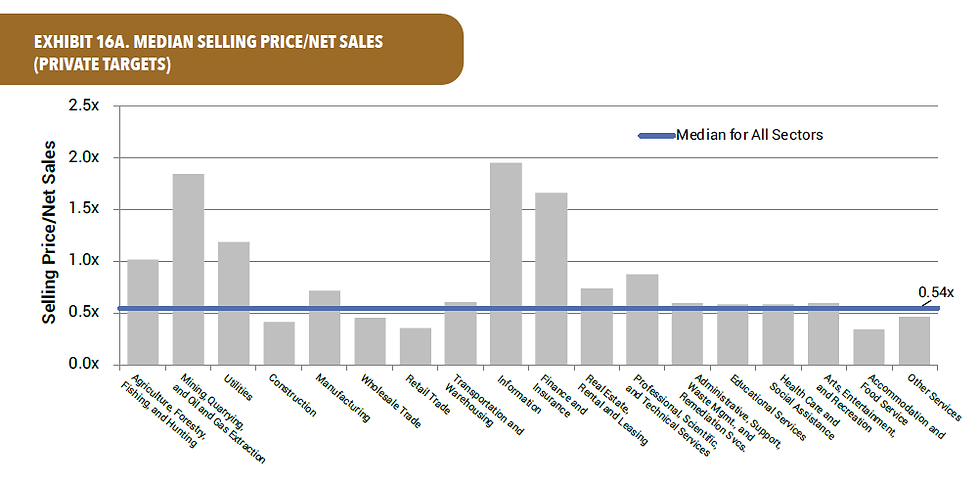

Below is a chart that shows median business sales prices as a multiple of revenue/sales up to the 3rd quarter of 2017. Businesses tend to sell for a fraction of revenue in most industries, not multiples. Further, a slight difference in the fraction has a dramatic swing in implied value when applied over the annual revenues.

(Source: Dealstats 2021)

What is a business worth to sell?

Selling price to revenue multiples vary by business type, it is due to the varying profit margins in each industry group. Manufacturers will, on average, have higher profit margins, than retailers and wholesalers. That’s why the manufacturers sell for higher multiples of revenue than do retailers.

Valuation multiples by Industry

There are exceptions in certain industries that are experiencing hyper-growth and there is a lot of M&A activity (merger and acquisition) where multiple offers are bidding one another up and buyers are paying inflated prices, or multiples times revenue even for companies that are not profitable. While the average multiple is 0.54x, mining and technology sectors tend to transact at much higher multiples of revenues than the retail or accommodation sectors as shown by the graph below.

Multiples of revenue are easy to understand and apply, but in most cases, businesses are valued based on multiples of cash flow taking into consideration of all the individual risk and value drivers, industry characteristics,high-growth, and current economic factors impacting both the business and given industry. Multiples or fractions of revenue can be a good secondary sanity check but NOT a primary business valuation approach.

_____________________________________

What do we do: Malahat Valuation Group specializes in business valuation and equipment appraisals to owners of privately-owned companies and their professional advisors.

Why it matters: When business owners and their professional advisors need to sell, leverage or reorganize their assets, we answer the age-old question of "what is it worth"?

Who cares: We provide our clients and their advisors a peace of mind by providing professional valuations that stand up to scrutiny from the Courts and CRA.

BUSINESS VALUATIONS - REAL ESTATE APPRAISAL - EQUIPMENT APPRAISAL

Malahat Valuation Groupwww.MalahatValuationGroup.com

250-929-2929

Comments